Table of Content

- Margin Norms and Loan to Value Ratio

- SBI Personal loan interest rate 2022 | Get Instant loan for your need.

- Top Personal Loan Cities in India

- Bank of Baroda Home Loan Calculator

- Document Required to Apply for Bank of Baroda Home Loan

- Bank of Baroda Home Loan Details

- Bank of Baroda Home Loan Eligibility

- Bajaj Finance Perintalmanna Personal Loan – Contact Number, Branch

Also, make the most of coins and annual offers from Loyalty Rewardz to fulfill yearlong subscriptions and shopping. Getting an education loan is an easy way to finance your dreams. A student loan can help you get into the university of your choice. Bank of Baroda is here to finance your dreams, education & career goals.

They have fulfilled my need by approving the entire amount , the processing fee was there it was minimal. But I suggest the service needs lots of improvement because they collected documents five times from me it was really disappointed. I am processing a home loan with Bank of Baroda and they are offering good service. I am not satisfied with the customer service but the rate of interest was good.

Margin Norms and Loan to Value Ratio

The lenders that have revised their rates include ICICI Bank, Canara Bank, Bank of Baroda and Punjab National Bank. These banks have adjusted the external benchmark rates linked to the repo rate. RBI is widely expected to hike the repo rate on September 30. With another high repo rate hike knocking at the door, home loan borrowers are likely to soon face even higher interest rates than at present.

With tenures of up to 30 years and affordable interest rates, several individuals turn to Bank of Baroda for home loans. However, its repayment is a significant financial responsibility. That’s why individuals may use a Bank of Baroda home loan calculator to plan their repayment better. According to the BOB home loan eligibility calculator, the home loan that you can get on INR 80,000 monthly salary, with an interest rate of 6.85% and a tenure of 30 years, can be of around 60 lakhs. According to the BOB home loan eligibility calculator, the home loan that you can get on INR 50,000 monthly salary, with an interest rate of 6.85% and a tenure of 30 years, can be of around 35 lakhs. Customers' loans became more expensive as a result of Bank of Baroda and Indian Overseas Bank raising their margin cost of funds based lending rates .

SBI Personal loan interest rate 2022 | Get Instant loan for your need.

Till date over 10 other banks have been merged with the Bank of Baroda. Notifications can be turned off anytime from browser settings. Time frame for taking credit decision/disposal of proposal from the date of submission of data/information is within 10 working days for all credit facilities up to Rs. 3,00,000.

Extended loan tenures up to 30 years and zero charges on pre-payments and foreclosure ensure a comfortable loan repayment period. The Bank of Baroda also offers free accident insurance on all their loans. You can apply for BOB Home loan online on the bank’s official website and by then filling the home loan application form. You can also download the BOB application and apply online through the app.

Top Personal Loan Cities in India

These deposits are categorised into deposits with a term period of less than 12 months, more than 12 months and recurring deposits. Digi Hub is one of the innovative solutions that Bank of Baroda is pioneering to serve its Radiance customers outside large cities where bank has relatively leaner presence of specialized investment teams. LTV indicates the portion of property value that can be financed by a lender to a borrower. Margin, on the other hand, is a percentage of the property value to be paid by a borrower to avail a loan from the lender. As soon as you complete the above steps, your home loan EMI will be displayed along with other details such as total amount payable and also total interest payable.

Baroda home Loans offer you the flexibility for acquiring ready to occupy house/flat from developers or by choosing re-sale properties and takeover of from other banks. During its MPC meeting on Friday, the Reserve Bank of India increased the repo rate by 50 basis points to 5.40 percent. Locate the nearest bank branch where you would like to apply for the loan or go online to the bank’s website.

Bank of Baroda Home Loan Calculator

The calculator uses the below formula to calculate an EMI. I had applied for a home loan and It was with BANK OF BARODA .I was highly impressed. My home loan was approved in few days.Loan amount is satisfactory . They are awesome and they take care of you need very well.The good thing about BANK OF BARODA is their customer service. Mr. Jhunjhunwala avails a home loan from Bank of Baroda.

They immediately sanctioned loan and it got credited within 15 days. Individuals may want to keep these factors in mind when using the Bank of Baroda home loan calculator to maximise their benefits. Bank of Baroda home loan EMI per lakh starts from Rs. 655. The EMI can be easily calculated using the Bank of Baroda home loan calculator 2022. The loan tenure of the Bank of Baroda ranges from 5 to 30 years.

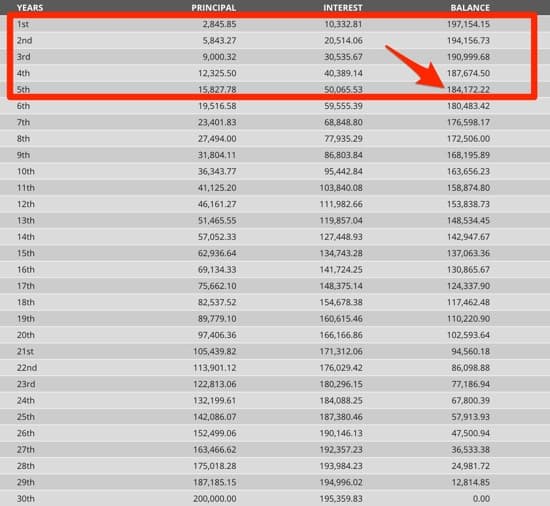

I have chosen them because they have provided me a best rate of interest available in the market. When i got the loan it was 8.3% which is a floating one. A detailed amortization schedule indicating all your debt repayments towards the principal and interest component of your home loan is also provided. Interest rate – The EMI a borrower has to pay is directly dependent on the interest rate. If the interest rate is high, EMIs will increase proportionately, and vice versa. Use this calculator to evaluate EMI for switching banks.

The Bank of Baroda home loan EMI is computed based on the applicant’s loan tenure, principal loan amount, and interest rate. You will just have to enter all this information in the Home loan EMI calculator in order to calculate the Bank of Baroda Home Loan EMI. The experience with this Home loan has been quite good and the loan amount which they had provided has been satisfactory as well. The interest rate with them has been nominal when compared with the market rate and the processing fee has been not too high.

The extent covered in the scheme is 90 % of amount default for a loan amount up to Rs 2 lakhs and 85 % when the loan value is between 2 lakhs and 5 lakhs. All resident or non-resident Indians are open to apply for this loan. They can be self-employed or salaried, but HUFs cannot apply for this program. Renovation is indeed a costly deal, but it’s the road connecting dreams to reality. BOB gives wings to the dreams by offering easy-to-process and user-friendly loans. The Bank of Baroda a multinational financial service provider is functioning under the Government of India.

Example – Below is pre-calculated personal loan EMI is given, it will give give you idea about monthly installment. Address Proof – Passport, telephone bill, ration card, electricity bill, driving license, life/medical insurance policy, rental agreement, apartment allotment letter. Bank of Baroda offer loans to Pensioners/ Defense Pensioners.

No comments:

Post a Comment